How to Invest in Stocks for Beginners

Investing in stocks has long been a way for people to grow their wealth over time. The stock market can be intimidating for those who are new to trading because of its jargon, volatile prices, and seemingly intricate tactics. However, anyone can begin investing in stocks with a little knowledge and perseverance. The purpose of this tutorial is to give novices a thorough understanding of stock investing and lay the groundwork for wise decision-making.

1. What Are Stocks?

The first step in understanding how to invest in stocks is to grasp what stocks are and how they work. To put it simply, stocks are ownership stakes in a business. Purchasing shares entitles you to a portion of the company’s ownership. You effectively get a portion of the company as a shareholder.

Owning stocks can be profitable in two ways:

- Capital Appreciation: Should the business prosper and expand, the stock price may rise, enabling you to sell your shares for a profit.

- Dividends: A percentage of a company’s profits are distributed to shareholders by certain businesses. These payments can be cashed out or reinvested to purchase additional shares.

2. Why Invest in Stocks?

Stocks can be one of the most rewarding long-term investments, especially when compared to other investment vehicles like bonds, savings accounts, or real estate. Over the past century, stocks have historically provided higher returns than almost any other asset class.

While stocks can be volatile in the short term, they tend to outperform other assets over long periods. After accounting for inflation, the stock market has historically yielded returns of roughly 7–10% each year on average. This makes stocks an excellent choice for growing wealth, particularly for long-term goals such as retirement or funding a child’s education.

3. Set Clear Investment Goals

Before you dive into the stock market, it’s essential to set clear, realistic investment goals. The way you invest in stocks will depend largely on your financial objectives.

- Short-Term Goals (1-3 years): If you need the money in the near future, stocks may not be the best option, since stock prices can fluctuate dramatically in the short term. In these cases, more conservative investments like bonds or high-yield savings accounts might be a better choice.

- Long-Term Goals (5 years or more): Investing in stocks may be an excellent approach to increase your wealth if your goals are five years or more in the future because equities often do well over that time.

Consider your risk tolerance, time horizon, and how much money you need to achieve your financial goals. These factors will help you determine your strategy and how much you should invest.

4. Open a Brokerage Account

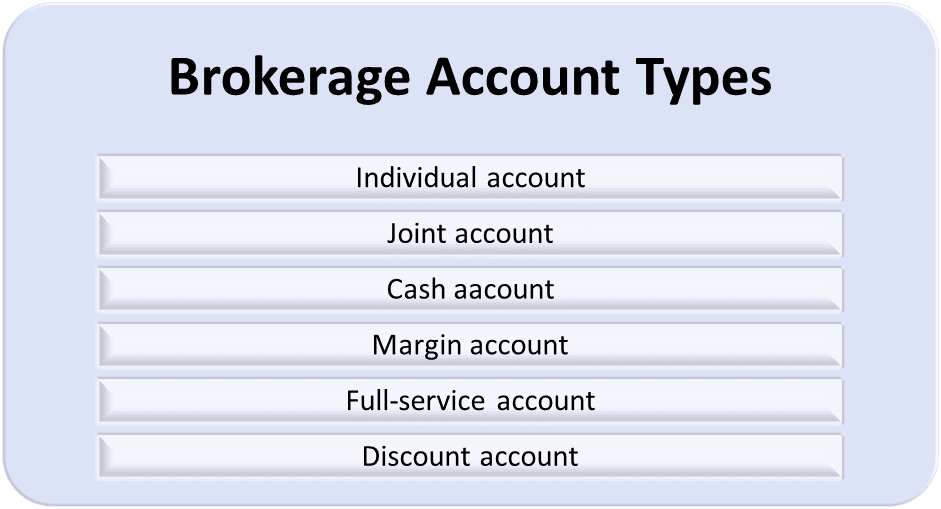

In order to invest in stocks, you’ll need to open a brokerage account. You can purchase and sell stocks through a brokerage, which acts as a middleman between you and the stock market. Such accounts can be created via conventional brick-and-mortar businesses or online platforms.

When choosing a brokerage, consider these factors:

- Fees: Some brokers charge commissions for every trade, while others offer commission-free trades. To keep more of your money invested, look for platforms that charge as little as possible.

- Investment Tools: Many online brokers offer educational resources, research tools, and guidance to help beginners navigate the stock market.

- Account Types: Brokers offer various account types, such as taxable accounts and tax-advantaged accounts like IRAs or 401(k)s. If you’re investing for retirement, an IRA may be a better option as it comes with tax benefits.

Some popular brokerage platforms for beginners include:

- Robinhood: renowned for its commission-free trading and easy-to-use interface.

- Fidelity and Charles Schwab: These websites provide excellent customer support, a wealth of instructional materials, and affordable prices.

- E*TRADE: Provides a multitude of research tools and a broad choice of investment alternatives.

5. Determine How Much to Invest

One of the most important decisions you’ll make when investing in stocks is how much money to invest. While there’s no one-size-fits-all answer, here are a few guidelines:

- Start Small: As a beginner, it’s wise to start with a smaller amount that you can afford to lose. This helps reduce the stress of making mistakes while you’re learning.

- Emergency Fund: Before you start investing, make sure you have an emergency fund in place. This is typically 3-6 months’ worth of living expenses set aside in a liquid savings account. This ensures that you won’t need to sell stocks in a hurry if you encounter unexpected financial challenges.

- Dollar-Cost Averaging (DCA): Instead of investing a lump sum all at once, many beginners prefer dollar-cost averaging, where you invest a fixed amount at regular intervals (e.g., monthly). This method reduces the risk of investing all your money at the wrong time, particularly during market volatility.

6. Understanding the Risks of Stock Investing

It’s critical to recognize the dangers associated with stock investment. Stock prices can be volatile, and there’s no guarantee that your investment will grow. In fact, you could lose money.

Some common risks include:

- Market Risk: The entire market can go through periods of downturn, affecting the value of most stocks.

- Company-Specific Risk: Individual companies may face financial difficulties, poor management, or other problems that can lower the value of their stock.

- Volatility: Short-term stock price fluctuations can be extremely intense. It’s not uncommon for stocks to experience sharp drops in price before recovering.

While the potential for high returns exists, it’s important to have a well-thought-out strategy to mitigate risk and avoid making impulsive decisions when the market fluctuates.

7. Diversify Your Portfolio

A few of the most crucial financial concepts is diversification. It involves spreading your investments across different types of assets (stocks, bonds, real estate) and different sectors of the economy. Diversifying helps reduce risk because not all investments will perform poorly at the same time.

For example, if you invest only in technology stocks and the tech sector suffers a downturn, your entire portfolio could take a hit. But if you diversify by investing in other sectors such as healthcare, finance, or consumer goods, the loss in one sector may be offset by gains in others.

You may diversify your stock investments in a number of ways.

- Individual Stocks: If you prefer to pick stocks yourself, choose companies from different industries and sectors.

- ETFs (Exchange-Traded Funds): ETFs are funds that hold a variety of stocks, often from different sectors or even different countries. They are a simple way to achieve diversification without having to pick individual stocks.

Mutual Funds: Like ETFs, mutual funds pool money from investors to buy a variety of stocks. Skilled fund managers usually oversee them.

8. Learn the Basics of Stock Analysis

As you begin investing, it’s essential to understand how to evaluate the stocks you’re interested in. While advanced investors may use a variety of complex tools, beginners can start by learning the basics of stock analysis.

- Fundamental Analysis: This type of analysis involves looking at a company’s financial health by studying key financial metrics such as earnings, revenue, debt, and profit margins. You’ll want to invest in companies with strong growth potential and sound financials.

- Technical Analysis: This involves analyzing price charts to predict future movements based on historical trends. Although this method is often used by more experienced traders, it can be helpful for beginners interested in understanding stock price movements.

As a beginner, fundamental analysis is usually a better place to start since it focuses on the long-term health of a company.

9. Stay Disciplined and Avoid Emotional Decisions

The stock market can be volatile, and it’s easy to let your emotions guide your decisions. During periods of market decline, fear can drive investors to sell, locking in losses. On the flip side, greed can lead you to buy at peak prices, chasing after quick profits.

Remember the following guidelines to steer clear of emotional investing:

- Stick to Your Strategy: Stay disciplined and follow the investment strategy you’ve set, whether it’s value investing, growth investing, or something else.

- Long-Term Focus: Stock prices fluctuate in the short term, but over the long term, they tend to reflect the performance of the underlying company. Keep your eyes on your long-term goals, and don’t let temporary setbacks cause you to panic.

10. Monitor Your Investments over Time

Once you’ve made your first stock investments, it’s important to regularly monitor your portfolio to ensure it aligns with your goals. While you don’t need to check prices every day, reviewing your portfolio periodically can help you stay on track.

However, be careful not to make impulsive decisions based on short-term market fluctuations. Keep in mind that stock investing requires a sustained commitment.

Conclusion

One of the best methods to increase money is through stock investing, but it takes discipline, patience, and understanding. For beginners, the key to success is starting with the basics: understanding stocks, setting clear goals, choosing the right brokerage, diversifying your portfolio, and staying focused on the long-term.

As you gain experience, you can refine your strategy, add more complex investments to your portfolio, and work toward your financial goals. Keep in mind that investing is a process rather than a race. Thus, proceed cautiously, pick up knowledge along the way, and relish the process of gradually increasing your riches.